Can You Use Travel Eraser for an Expense That Was Already Paid Off Capital One Venture

Can You Use Travel Eraser for an Expense That Was Already Paid Off Capital One Venture

The Capital One Buy Eraser lets cardholders employ rewards to wipe eligible purchases off their credit card nib. Not surprisingly, this program is part of the reason travel credit cards from Capital Ane are so popular.

When you lot sign up for a select travel credit card from this issuer, you have the option to transfer your miles to a handful of airline and hotel programs or redeem them for any travel buy charged to your credit carte.

Erasing purchases is an attractive option for people who don't want to deal with complicated loyalty programs or find themselves "stuck" booking their travel based on accolade availability. Fortunately, the Capital One Buy Eraser program solves that problem by making redemptions easy to empathise.

If you lot're wondering how this program works and which travel credit cards it applies to, read on to larn more.

What is the Capital One Purchase Eraser?

The Capital One Purchase Eraser is a feature offered by the post-obit travel credit cards from Capital letter I:

- Capital One Venture X Rewards Credit Carte

- Capital 1 Venture Rewards Credit Bill of fare

- Capital One VentureOne Rewards Credit Card

- Majuscule One Spark Miles Select for Business

- Capital letter One Spark Miles for Business

This feature actively "erases" travel purchases charged to your carte, although y'all can only use it for travel purchases made inside the previous 90 days. When you compare this redemption pick to other travel programs offered by competing credit cards, information technology's like shooting fish in a barrel to see simply how convenient this is. Instead of searching for award availability with an airline or hotel program, you but employ your credit card to pay for whatever travel you want. After the fact, you'll "erase" all or part of your purchases using your Capital letter One miles.

This characteristic likewise makes it possible for y'all to volume travel with miles you haven't earned all the same. Imagine for a moment you lot're trying to earn the welcome bonus on the Venture carte du jour, which is 60,000 miles one time you spend $three,000 on purchases within three months from account opening, equal to $600 in travel. In that instance, you could charge $3,000 in purchases to your menu within three months (including at least $600 in travel expenses), earn the welcome bonus, then let Capital One erase purchases of travel made within the last ninety days using your miles.

As well, be aware that you tin can redeem your miles this way in any increments you want, pregnant yous can use your Capital One miles to comprehend a $3,000 vacation parcel or a $12 taxi ride. Because the Capital One Purchase Eraser rules are then flexible, you can use your miles in small increments or salvage them upward to cover a big travel purchase all at once.

Capital I Purchase Eraser: How to use it

To redeem your Capital One miles for travel using the Purchase Eraser, you'll get-go by logging in to your Majuscule One account via a desktop, mobile app or by calling the Upper-case letter One Rewards Eye. You'll likewise want to make sure you have a travel buy to cover with your rewards, keeping in mind that the Purchase Eraser feature only works for travel purchases made in the last 90 days.

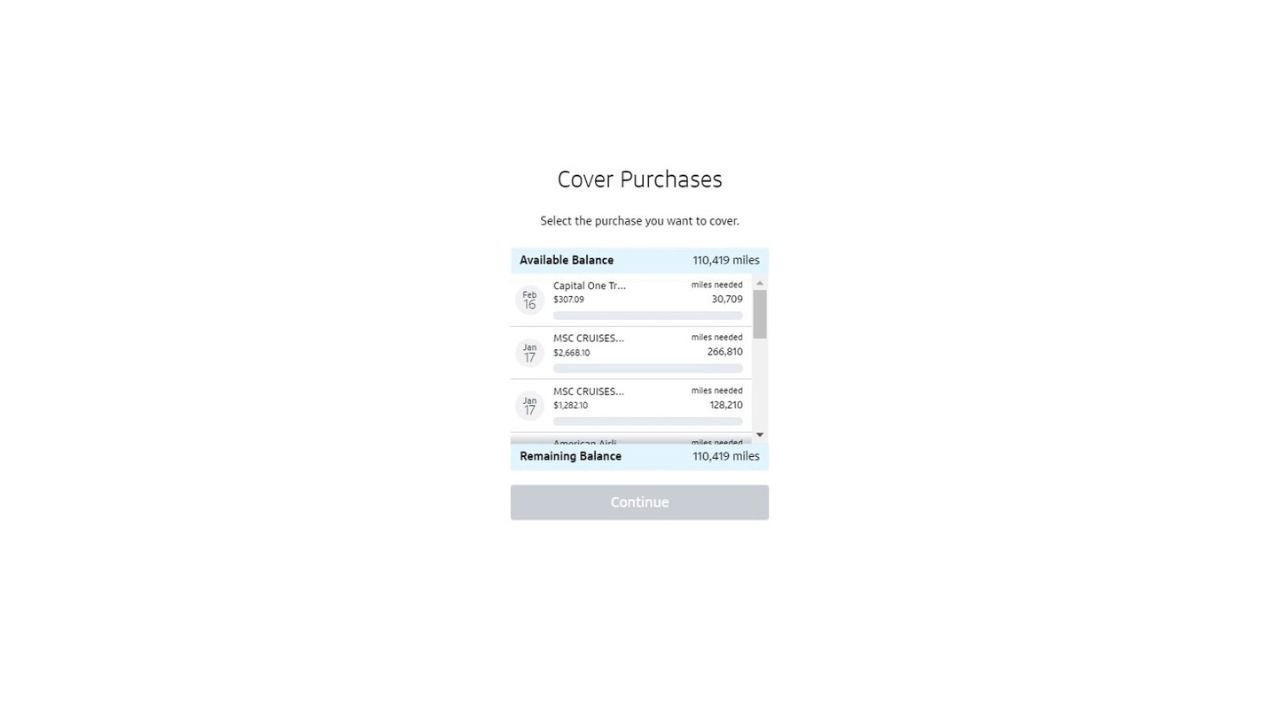

Step ane: Find the purchases you lot desire to cover with your miles. You can practise this through the online business relationship management page or Capital I's mobile app.

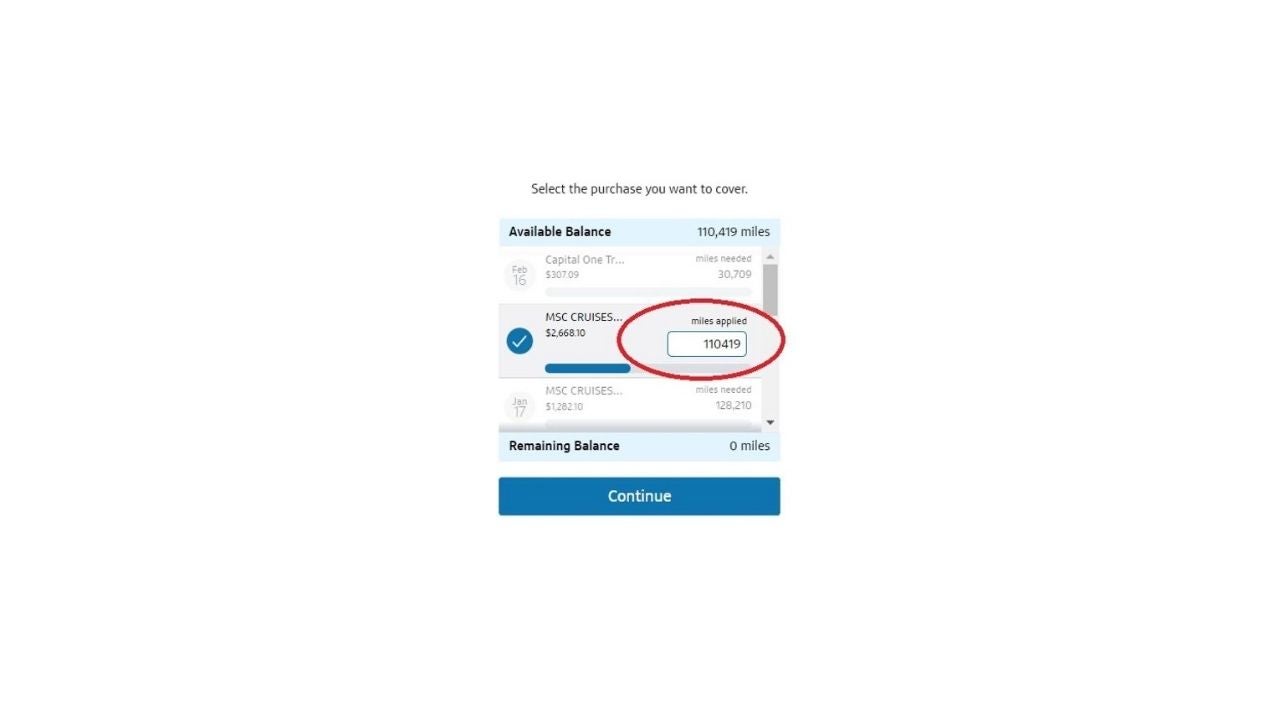

Step ii: Click on the travel buy y'all programme to redeem miles for and select how many miles you lot want to redeem. Remember that yous don't have to apply all your miles if you don't want to.

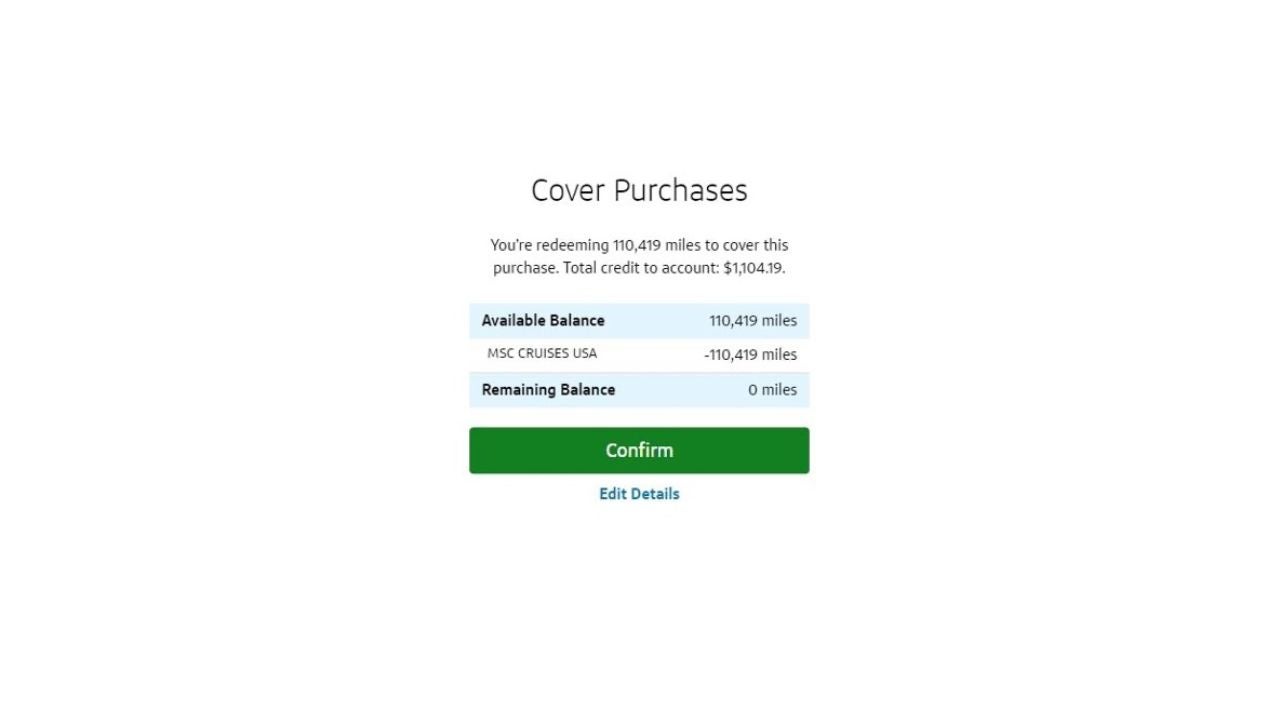

Stride 3: Redeem your miles to encompass a chosen travel purchase. Click on the travel purchase yous desire to cover, then brand certain you are willing to role with the number of miles required.

Step 4: Wait for the credit to show up on your account. In one case you lot've successfully redeemed miles for a travel buy, all yous take to do is wait for the purchase to exist "erased" from your account.

What are the different types of purchases that qualify for the Capital One Buy Eraser?

Generally speaking, nearly travel purchases charged to your card qualify for the Upper-case letter One Buy Eraser. According to Capital One, you tin can redeem your miles for "purchases like vacation rentals, machine rentals, airlines, hotels and more."

To redeem miles for travel purchases charged to your card, Uppercase One notes you should use the "Embrace Your Purchases" redemption choice.

Also, annotation that Capital One says you lot can likewise redeem your miles for options like gift cards or cash back, although redemption values volition vary.

Since cards that offer this feature are geared toward people who travel, most consumers focus on using Uppercase One miles for travel purchases that are traditionally difficult to encompass with airline miles and hotel points. For example:

- Disney vacations. Consumers often use Capital One miles to pay for rental condos or timeshare rentals near Disney resorts. You lot can likewise utilise Capital One miles to pay for airfare or a rental car to get there.

- Condo rentals. Rentals from Airbnb or VRBO are another category where it's common to use miles from a Capital One travel credit carte. You can encompass your condo rental with miles, whereas other travel credit cards don't offer this choice.

- Cruises. Covering a cruise with rewards is notoriously difficult, still the Capital One Purchase Eraser makes it easy to cover all or office of your cruise with miles.

- Vacation packages. If you desire to book a vacation package through a third party similar a travel amanuensis or a discount site like Expedia.com, the Purchase Eraser characteristic makes this option a breeze.

What are points worth when redeemed through the Buy Eraser?

Miles are worth one cent each when you redeem them through the Capital I Purchase Eraser, making a sign-up bonus of 60,000 miles (after spending $3,000 in the first three months) worth $600 right off the bat. Achieving one cent per mile in value is pretty typical among travel credit cards, although y'all might struggle to earn enough miles to pay for premium airfare or luxury travel at this charge per unit.

All the same, you lot should keep in mind that both the Venture Carte and Spark Miles for Business concern let you earn 2 miles for each dollar y'all spend, which can help you lot rack upwardly rewards faster than you could with other travel credit cards. The new Capital letter 1 Venture 10 lets you earn the aforementioned rate on regular purchases, yet y'all tin can besides earn 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Uppercase One Travel.

Purchase Eraser vs. statement credits: Is there a deviation?

Generally speaking, "erasing your purchase" ways the same affair as getting a statement credit to embrace a buy made to your credit carte du jour account. With that being said, the Purchase Eraser tin can truly be helpful if you're someone who wants to book any travel you lot want without limitations or coma dates.

The main difference betwixt this program and other rewards is the fact that Capital I lets you redeem miles using the Purchase Eraser afterward the fact, whereas you lot might use other rewards (like airline miles) to book your travel ahead of time.

Either selection can assistance you secure free or drastically discounted travel, so brand certain to research all the top travel credit cards before deciding which one is correct for you.

The lesser line

If you want to use the Majuscule One Buy Eraser to pay for your adjacent getaway, your kickoff pace is to sign up for an eligible credit bill of fare from Capital I. From at that place, you can kickoff earning miles on every purchase you make. Once you're ready, you can sit down back and sentry Capital letter One erase purchases from your credit card pecker.

Also, note that Capital 1 travel credit cards let you transfer your miles to eligible airline and hotel partners. Some too let you redeem your rewards for purchases made through Amazon.com or PayPal.

With all these options to cull from, including the Upper-case letter One Purchase Eraser, this rewards programme will never leave you "stuck" with miles y'all can't employ.

The data nearly the Capital Ane Spark Miles Select for Business card and U.S. Bank Business Platinum has been collected independently by Bankrate.com. The card details have non been reviewed or approved by the card issuer.

Can You Use Travel Eraser for an Expense That Was Already Paid Off Capital One Venture

Posted by: choiforel1974.blogspot.com

0 Response to "Can You Use Travel Eraser for an Expense That Was Already Paid Off Capital One Venture"

Post a Comment